when will i receive my unemployment tax refund 2021

The agency is working its way down to the more complex category and expects to complete releasing jobless tax refunds before Dec. Note that the Biden administration via the ARPA stimulus bill got.

2020 Unemployment Tax Break H R Block

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

. I filed my taxes on March 26 2022 but have not seen a refund. Because unemployment benefits are not considered earned income receiving unemployment rather than wages or salary may reduce. The IRS might seize.

At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. Refunds to start in May. Not at this point - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our.

You may check the status of your refund using self-service. Can you track your unemployment. The average refund for those who overpaid taxes on unemployment compensation was 1265.

If you use Account Services. 11 2021 Published 106 pm. IR-2021-151 July 13 2021 WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers.

The agency is working its way down to the more complex category and expects to complete releasing jobless tax refunds before Dec. Tax season started Jan. There are two options to access your account information.

When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. The IRS will continue reviewing and adjusting tax returns in this category this summer. IRS to recalculate taxes on unemployment benefits.

The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two or more. If you paid taxes on unemployment benefits received in 2020 you might get a refund or the IRS could seize it. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. The federal tax code counts jobless benefits. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

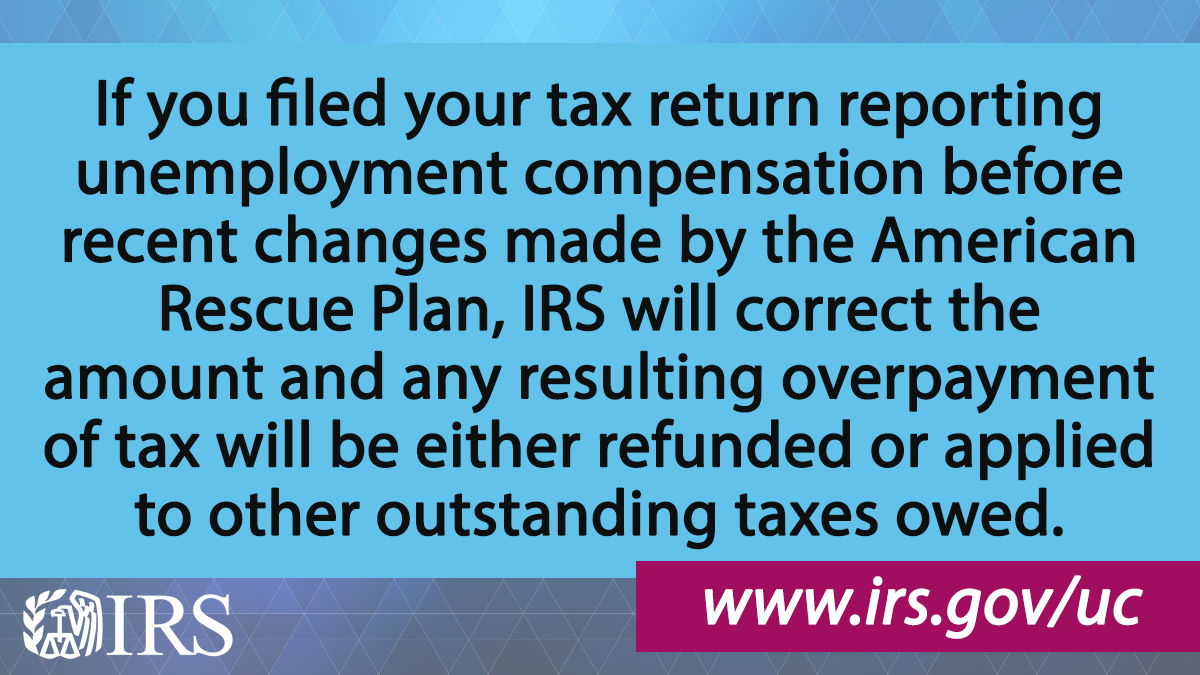

IR-2021-71 March 31 2021. If you received unemployment benefits in 2020 a tax refund may be on its way to you. The American Rescue Plan Act of 2021 changed the tax code so that the first 10200 of unemployment benefits you received in 2020 is free of federal taxes.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The 10200 tax break is the amount of income exclusion for. Can you track your unemployment tax refund.

For tax year 2021 the taxes you file in 2022. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021 along with meeting certain other criteria. WASHINGTON To help taxpayers the Internal Revenue Service.

The IRS effort focused on minimizing burden on taxpayers so that most people wont have to take any additional action to receive the refund. The IRS has sent 87 million unemployment compensation refunds so far. You will receive Form 1099-G with form your state UI agency to file with your 2020 income taxes in 2021.

Millions waiting for up to 200 direct payment - when you will see the cash. Account Services or Guest Services. 24 and runs through April 18.

2021 Tax Refund Why Have I Not Received My Payment As Usa

Irsnews On Twitter Irs Will Refund Money This Spring And Summer To People Who Filed Their Tax Return Reporting Unemployment Compensation Before The Recent Changes Made By The American Rescue Plan See

2021 Tax Refund Why Have I Not Received My Payment As Usa

Irsnews On Twitter If You Received Unemployment Benefits Last Year And Already Filed Your 2020 Tax Return Don T File An Amended Return Irs Will Be Issuing Guidance To Address Changes Brought By

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Irs Will Issue Special Tax Refunds To Some Unemployed Money

How To Receive Your Unemployment Tax Refund As Usa

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Ask Kip Refunds For Unemployment Tax Break On The Way

Rescue Plan Exempts 10 200 In Unemployment Benefits From Taxation

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Reporting Your Unemployment Benefits On Your 2020 Tax Return Slls

The Ui Tax Refund On My Transcript 1 229 23 Is Less Then The Unemployment Taxes Paid 2 606 Shown On My 1099g Is There Any Reason For This R Irs

Unemployment 10 200 Tax Break Some States Require Amended Returns

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com